R+V

Cumulative Claims Management System

The Challenge

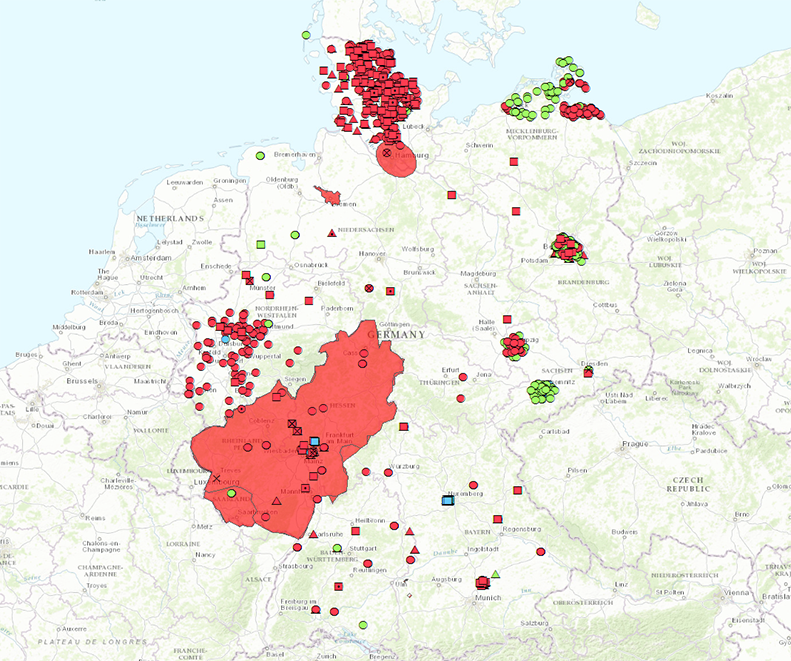

In insurance, cumulative claims are said to occur when several units covered by the same insurer are affected by a single loss event. Cumulative losses are frequently caused by natural disasters such as storms (e.g. Kyrill) or hail. Handling cumulative losses represents a considerable challenge to claims management teams in insurance organisations. It is for this reason that a geo-based solution for controlling cumulative claims was devised for R+V Versicherung, to give employees in the claims management department a GIS-aided method of modelling cumulative events and assessing the plausibility of incoming claims in an efficient and cost-optimised process.

The cumulative claims management system allows us to make a rapid assessment of a cumulative loss situation and enables us to react in the short term to new loss situations."

The Customer

R+V Versicherung is one of the largest insurance companies in Germany and belongs to the Genossenschaftliche FinanzGruppe Volksbanken Raiffeisenbanken. R+V Versicherung is characterised by its high risk-bearing capacity and has for many years been growing more strongly than the industry.

More than eight million customers in Germany trust in the services of the Wiesbaden insurer, with more than 24 million insurance policies. As a composite insurer, R+V provides specific solutions for both private customers and industrial, retail, commercial and agricultural organisations.

The Solution

The solution devised by con terra for controlling cumulative claims enables employees in the claims management department at R+V Versicherung to record and manage cumulative events interactively. The solution is based on ArcGIS technology from Esri. A central Enterprise Geodatabase is employed for data management, on the basis of a Microsoft SQL Server data-base.

Moreover, the solution comprises processes and interfaces that both transfer verified cumulative events into the central R+V Versicherung claims management system (DB2) and forward weather-relevant loss notifications from the claims management system as GIS data to the central Enterprise Geodatabase. The implementation and automated execution of the data transmission processes take place on the basis of FME spatial ETL technology.

The Solution is Based On

ArcGIS for Desktop

ArcGIS for Server Basic Enterprise

ArcGIS Online

FME Desktop

FME Server

Microsoft SQL Server

DB2 for z/OS

The Benefits

The cumulative control solution gives employees in the claims management department at R+V a way of quickly discerning the occurrence of a cumulative situation, allowing it to respond accordingly. It is now able to visualise and analyse incoming claims with GIS support, on the basis of weather-relevant loss notifications transferred to the Enterprise Geodatabase. This allows a rapid assessment of the situation and supports short-term decision making.

Cumulative events can now be quickly and simply modelled and fed into the claims system. This makes it possible to assess the plausibility of incoming claims in an efficient and cost-optimised process.

The implementation of the solution is based on a fully configurative approach. Future updates of the standard software components employed can therefore be performed with minimal effort. This ensures the solution‘s sustainability. Moreover, the GIS in-frastructure incorporated in the system is so flexible that it is a simple matter to integrate further application scenarios in the solution.